Glossary /

Affiliate Fraud: Types, Detection, and Prevention

Affiliate fraud is the deceptive practice where unscrupulous actors manipulate affiliate marketing programs to generate illegitimate commissions. It involves exploiting tracking systems to claim credit for bogus leads, fake sales, or organic traffic that the advertiser would have captured anyway.

What is Affiliate Fraud?

Affiliate fraud is a malicious activity where individuals or automated scripts game the performance-based marketing model to steal revenue from advertisers. Unlike legitimate affiliate marketing—where partners earn commissions for driving valid traffic or sales—fraudsters use technical exploits to fake these actions.

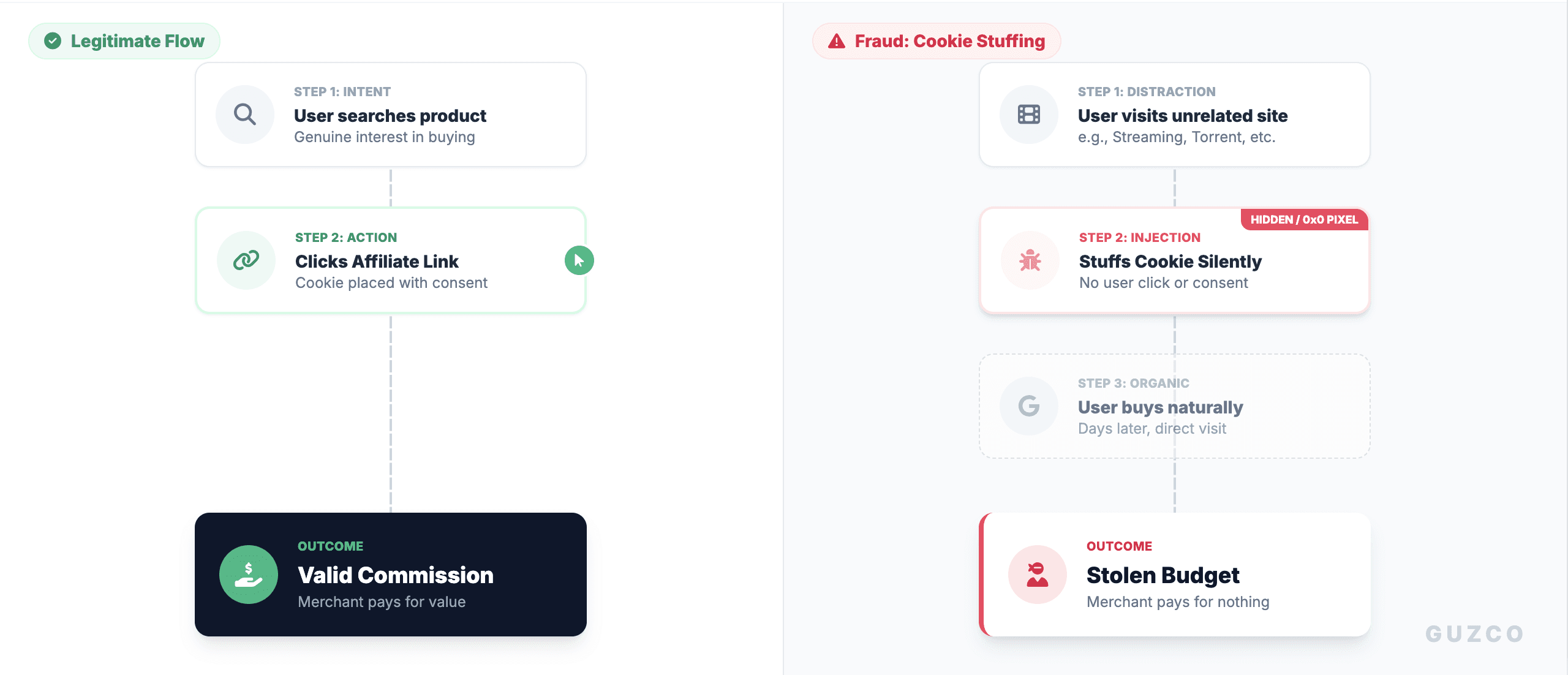

This fraud encompasses a wide spectrum of tactics, ranging from typosquatting (registering misspelled domains of the brand) to cookie stuffing (forcing tracking cookies onto users' browsers without their knowledge). The goal is always the same: to trick the merchant’s attribution software into believing the fraudster is responsible for a sale they did not actually generate.

Understanding Affiliate Fraud

To understand why affiliate fraud is so pervasive, one must look at the attribution model. Most affiliate programs operate on a "last-click" basis, meaning the last affiliate link a customer clicks before purchasing gets 100% of the commission.

Fraudsters exploit this by inserting themselves into the customer journey at the very end, often milliseconds before a transaction occurs. They do not "market" the product; they hijack the traffic.

The Mechanics of Exploitation

The "Freeloader" Effect: Fraudsters target users who have already decided to buy. By injecting a cookie or clicking an ad programmatically just before checkout, they claim a commission for a customer the brand had already won.

Automation at Scale: Modern fraud isn't manual. It utilizes botnets and residential proxies to simulate human behavior, making thousands of fake "clicks" or "leads" that look legitimate to basic analytics tools.

Incentive Misalignment: High-payout programs (e.g., SaaS subscriptions or financial services) attract the most sophisticated attacks because a single successful conversion can yield significantly more profit than the cost of the attack vector.

Impact & Detection (2024-2025 Data)

Affiliate fraud is no longer a niche nuisance; it is a multi-billion dollar drain on global marketing budgets.

Key Statistics

Financial Loss: Global ad fraud costs are projected to grow from $114 billion in 2025 to $172 billion by 2028, according to Statista.

Prevalence: Recent reports from 2024 indicate that mobile affiliate fraud rates can be up to 50% higher than desktop fraud due to vulnerabilities in mobile app attribution.

Hidden Waste: It is estimated that fake leads are 4.5 times more prevalent in organic channels than in paid ads, suggesting fraudsters are aggressively targeting unpaid traffic sources to blend in.

Specific Vector Impact: Cookie stuffing alone is estimated to account for up to 60% of all affiliate fraud cases.

Signs of Attack ("How to Detect")

Detecting fraud requires looking for anomalies in data patterns rather than just analyzing individual transactions.

Abnormal Conversion Rates: A conversion rate (CVR) that is too high (e.g., 20%+) or suspiciously consistent (e.g., exactly 2.5% every day) is a red flag.

Time-to-Conversion (TTC): If the time between the "click" and the "conversion" is impossibly short (milliseconds), it indicates Click Injection. Conversely, if it is always exactly 29 days (just before cookie expiry), it suggests automated script activity.

Traffic Spikes: Sudden surges in traffic from a single sub-affiliate or specific geographic region (especially low-value data center IPs) often indicate bot activity.

Prevention & Solution

Mitigating affiliate fraud requires a "defense-in-depth" strategy, combining human oversight with automated blocking.

1. Vetting & Onboarding

Manual Review: Never auto-approve affiliates. require a valid website, social media presence, and a description of promotional methods.

Terms of Service (ToS): Explicitly ban brand bidding (buying ads on your own brand name) and direct linking in your ToS. This gives you the legal ground to withhold commissions.

2. Technical Safeguards

Browser Fingerprinting: Implement tools that can identify device fingerprints. If hundreds of conversions come from different IPs but the same device fingerprint, it is a bot farm.

Disable IFrames: Ensure your affiliate tracking pixel cannot be loaded inside an invisible

<iframe>. This is the primary method used for cookie stuffing.IP Blacklisting: Regularly update blocklists to exclude known data center IP addresses (e.g., AWS, Azure exit nodes) from being attributed to sales.

3. Monitoring & Auditing

Attribution Windows: Shorten your cookie duration. A 30-day window is standard, but reducing it to 7 or 14 days reduces the window of opportunity for cookie stuffers.

Referrer Audits: Check the

HTTP_REFERERlogs. If the traffic source is "blank" or comes from an unrelated site (e.g., a torrent site or adult content), flag the affiliate.Clawback Clauses: Include a clause in your contracts that allows you to deduct fraudulent commissions from future payouts or demand repayment.

Affiliate fraud evolves as quickly as detection technology. As we move through 2025, the rise of AI-driven fraud (using Generative AI to create fake sites and leads) poses a new threat. Marketers must shift from a passive "set and forget" mentality to active, real-time monitoring. Protecting your program isn't just about saving money—it's about ensuring your marketing data remains clean enough to make accurate business decisions.

Item Not Received (INR)