Glossary /

Item Not Received (INR)

What is Item Not Received?

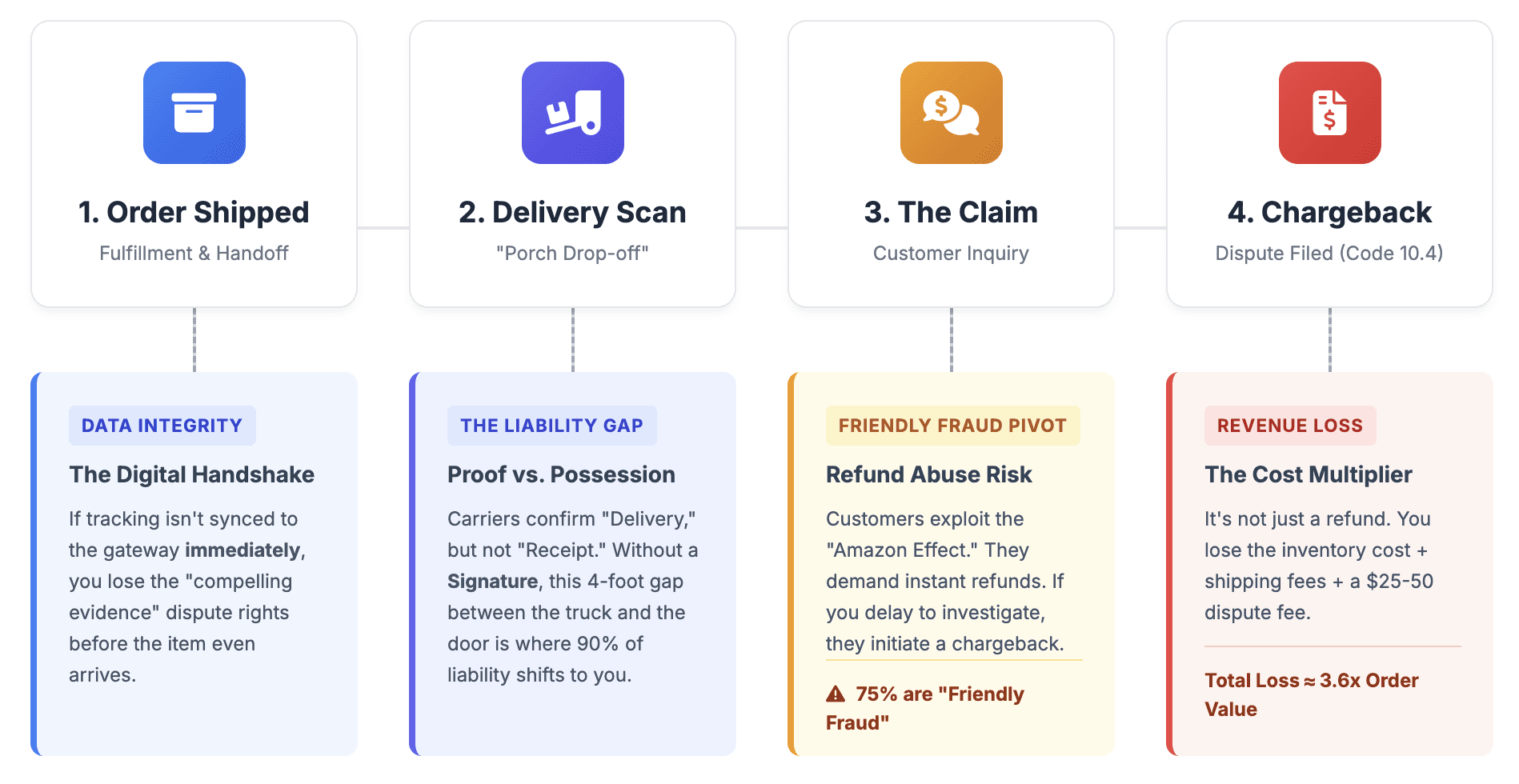

Executive Summary Item Not Received (INR) is a specific type of chargeback or claim where a cardholder asserts they purchased goods or services that were never delivered. While legitimate INR claims exist due to logistics failures, INR has increasingly become a vehicle for "Friendly Fraud" (or First-Party Misuse), where customers receive the item but falsely claim non-delivery to secure a refund. As of 2024, friendly fraud accounts for up to 75% of all chargebacks, making INR a critical revenue-protection priority for merchants.

Item Not Received Common Codes

In the payments ecosystem, INR is classified by specific chargeback reason codes that alert the merchant to a dispute.

Visa: Reason Code 10.4 (Other Fraud – Card-Absent Environment) or 13.1 (Merchandise/Services Not Received).

Mastercard: Reason Code 4853 (Goods or Services Not Provided).

American Express: Reason Code C08 (Goods/Services Not Received or only Partially Received).

Technically, an INR claim initiates a dispute process where the burden of proof shifts to the merchant. The merchant must prove not just that the item was shipped, but that the cardholder received it.

Understanding INR: The "Friendly Fraud" Shift

Historically, INR claims were straightforward errors: a package was lost by the carrier. However, the landscape has shifted dramatically toward Refund Abuse.

The Psychology of INR Fraud

Modern INR fraud is often driven by "cyber-shoplifting." Customers exploit the disconnect between shipping carriers and merchant liability.

The Loophole: Carriers often leave packages at doorsteps ("porch drop-offs") without signatures. Fraudsters know that a standard "Delivered" scan is often insufficient evidence for banks to reverse a chargeback.

The Trend: Reports from 2024 indicate a surge in "Double-Dipping," where a consumer keeps the product and gets the refund, essentially getting the item for free.

The Financial Impact

The cost of an INR chargeback extends far beyond the lost inventory. According to 2024 industry data:

True Cost: For every $1 of fraud loss, merchants lose approximately $3.60 when factoring in shipping, fees, and operational overhead.

Rising Volume: Global ecommerce fraud loss was estimated to approach $48 billion annually, with INR being a leading contributor in the retail sector.

Mechanics: Visa Compelling Evidence 3.0 (CE 3.0)

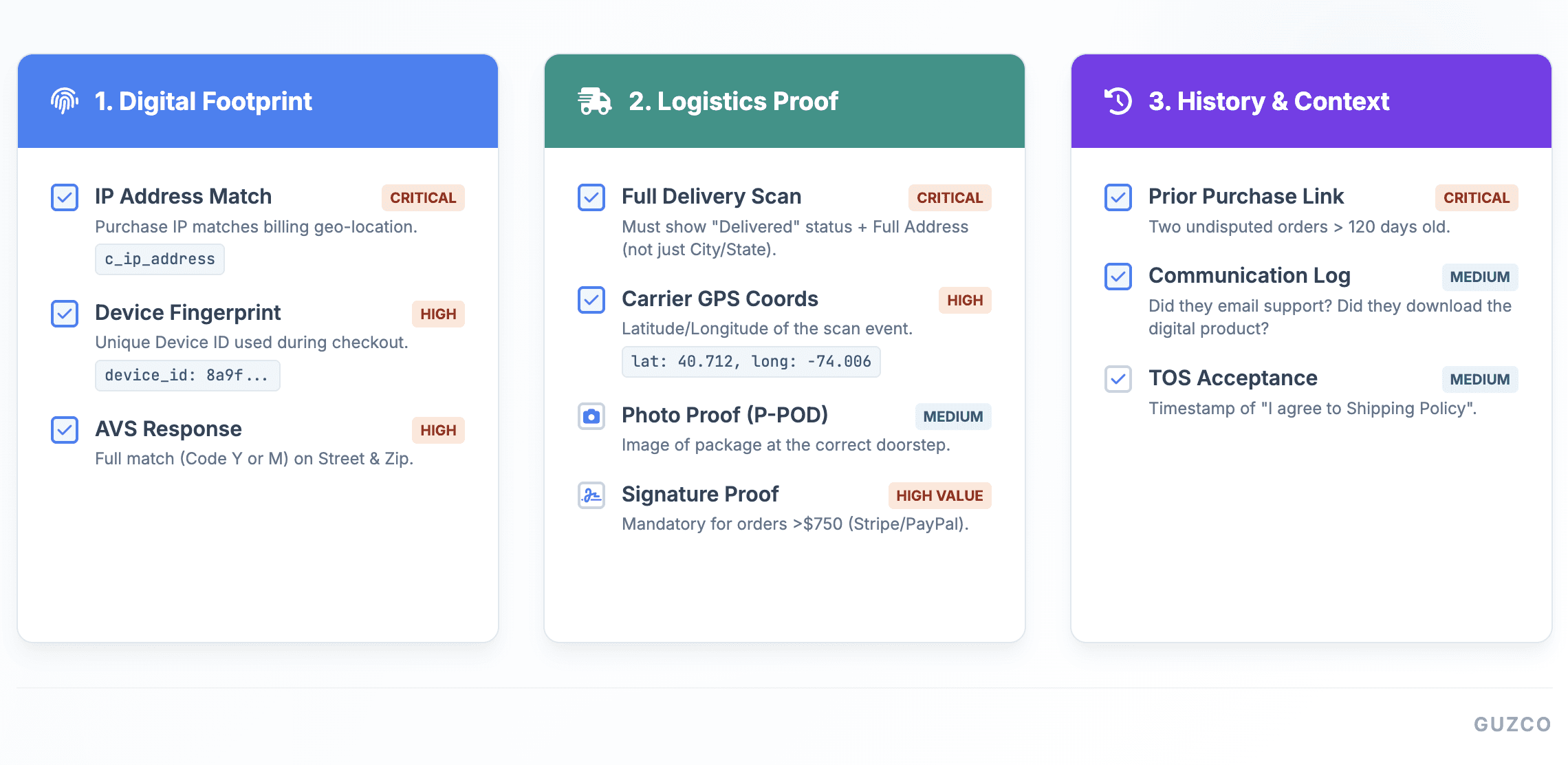

A critical update for merchants fighting INR claims is Visa’s Compelling Evidence 3.0, which became fully effective in April 2023. This rule change was designed specifically to combat friendly fraud.

How it Works: Previously, proving delivery was difficult if the customer claimed "porch piracy." Under CE 3.0, merchants can now block INR disputes (Reason Code 10.4) by proving a "Historical Footprint" of legitimate behavior.

To qualify, a merchant must provide:

Two prior undisputed transactions from the same cardholder.

Age of transactions: Must be between 120 and 365 days old.

Matching Data: The prior transactions must match the disputed one on at least two core elements:

IP Address

Device ID / Fingerprint

Shipping Address

Account ID

If a merchant successfully provides this data, the liability shifts back to the issuer, preventing the chargeback.

Prevention & Mitigation Strategies

Preventing INR requires a mix of logistics, technology, and policy enforcement.

1. Operational Best Practices

Tracking Numbers: Mandatory for every order. Ensure the tracking link is synced immediately to the payment processor (e.g., Stripe, PayPal, Shopify).

Signature Confirmation: The "Gold Standard" of evidence. Require signatures for orders over a specific threshold (e.g., $150+).

Live Shipping Updates: Send proactive emails/SMS when the item is "Out for Delivery" and "Delivered" to reduce ambiguity.

2. Strategic "INR Protection"

Many merchants now use third-party fraud protection platforms (like NoFraud, Signifyd, or Riskified) which offer INR Protection guarantees.

How it works: These services screen transactions for high-risk indicators (e.g., mismatched billing/shipping addresses, high-velocity ordering).

Reimbursement: If an approved order results in an INR chargeback, the provider reimburses the merchant, effectively acting as insurance against this specific fraud type.

3. Documentation for Dispute Representation

If you receive an INR chargeback, submit the following evidence immediately:

Proof of Delivery (POD): Must show the full delivery address (not just "City, State").

Geolocation Data: Carrier logs showing the GPS coordinates of the delivery scan.

Customer Communications: Emails or chat logs where the customer may have acknowledged receipt or agreed to specific delivery terms (e.g., "Leave at back door").

Item Not Received has evolved from a shipping error into a sophisticated form of first-party fraud. While carriers are responsible for the logistics, merchants are financially liable for the dispute. Defeating INR fraud today requires leveraging data-driven defenses like Visa CE 3.0 and maintaining rigorous shipping documentation to prove that the "Item Not Received" claim is invalid.

Fake Tracking ID (FTID)