The AVS mismatch myth: why your fraud filter is rejecting good money

Updated

Dec 4, 2025

In the high-stakes environment of e-commerce, the moment of checkout is the finish line. You have attracted the customer, they have filled their cart, and they are ready to pay. But for thousands of merchants, this victory is snatched away at the last second by a silent revenue killer: the AVS mismatch.

For decades, the Address Verification Service (AVS) has been the standard "guard dog" of online payments. It performs a simple numeric check, comparing the billing address provided by the shopper with the address on file at the issuing bank. When the numbers don’t align perfectly, the system flags it as an AVS mismatch.

The knee-jerk reaction for many merchants is to set their payment gateways to automatically decline these transactions. It seems like a logical safety measure—if the address doesn't match, surely the card is stolen?

The reality, however, is far more expensive.

Treating an AVS mismatch as definitive proof of fraud is an outdated strategy that bleeds revenue. Data suggests that the vast majority of orders flagged for address mismatches are actually legitimate customers making simple human errors—typos, moving to a new apartment, or confusing shipping and billing fields. By letting rigid AVS filters make the final decision, merchants aren't just blocking fraudsters; they are locking the doors on their best customers.

In this article, we will dismantle the myth that "Mismatch equals Fraud." We will look at why these errors occur, the hidden cost of false declines, and how to adopt a smarter, context-aware approach to approval that protects your business without sacrificing your growth.

Deconstructing the Code: What AVS Actually Checks

To understand why AVS filters often fail, you must first understand the surprisingly rudimentary way the system works. In an era of AI and biometric data, AVS remains a relic of the 1990s.

When a transaction occurs, the AVS check does not look at the customer’s name, nor does it verify the full text of the street address. Instead, it strips the address down to its numeric elements.

The system compares two specific data points provided by the shopper against the records held by the issuing bank:

The Street Number: (e.g., The "10" in "10 Astor Place")

The ZIP/Postal Code: (e.g., "10003")

If you live at 123 Maple Avenue, Apt 4B, the system ignores "Maple," "Avenue," and "Apt." It simply looks for 123 and 4. If the bank has "123" on file and the customer types "123," it’s a match—regardless of who is actually holding the card.

The "Alphabet Soup" of AVS Codes

When the issuing bank responds to the merchant's request, they don't send a simple "Yes" or "No." They send a single-letter code indicating the level of accuracy. While these codes vary slightly between card networks (Visa, MasterCard, Amex), they generally fall into three buckets:

1. The Full Match (Codes Y, X, D, M)

What it means: Both the street number and the ZIP code match the bank's records.

The Assumption: This is a safe order.

The Reality: While often safe, professional fraudsters know this. They buy "Fullz" (stolen card details that include the billing address) on the dark web. A full AVS match proves the person knows the address, not that they live there.

2. The Partial Match (Codes A, Z, W)

What it means: One element matches, but the other does not.

Code A: Address matches, ZIP does not.

Code Z: ZIP matches, Address does not.

The Assumption: High risk. The thief might know the area (ZIP) but not the house number.

The Reality: This is the "False Decline" danger zone. This is often a legitimate customer who made a typo or recently moved.

3. The Mismatch (Code N)

What it means: Neither the street address nor the ZIP code matches.

The Assumption: Definitely fraud.

The Reality: Surprisingly, this is not guaranteed fraud. It often happens with international orders (where AVS isn't supported), corporate cards, or gift cards where no address is registered.

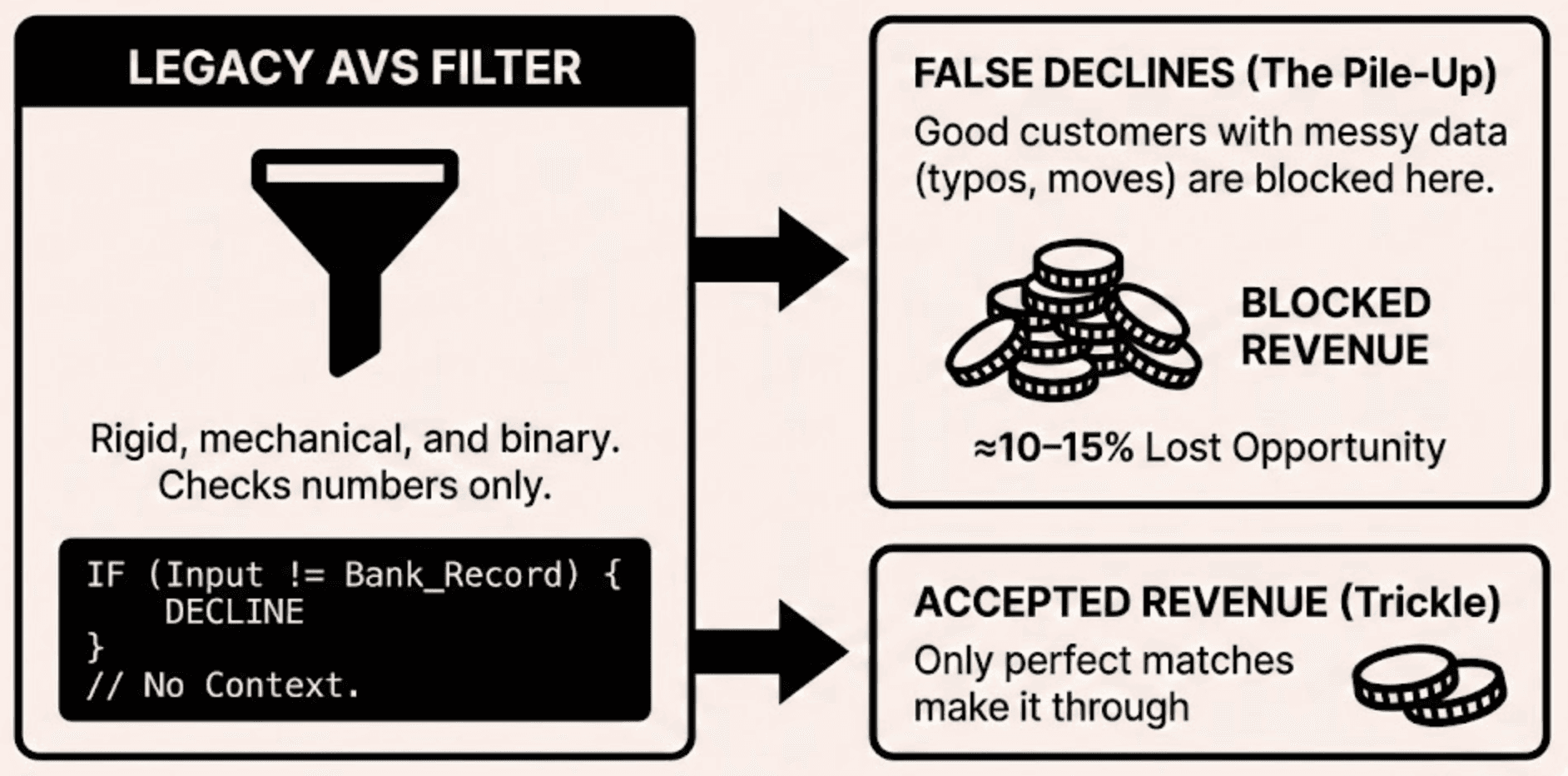

The "Filter" Problem

The core issue isn't the codes themselves—it’s how merchants use them. Payment gateways encourage merchants to set "automatic rejection rules." For example, a merchant might tick a box that says: "Automatically decline any transaction that returns Code N or Code Z."

By doing so, you are handing over your decision-making power to a simple numeric comparison tool that lacks context. You aren't analyzing the customer; you are analyzing a keystroke.

The Innocence of Error: Why Good Orders Look Bad

If AVS filters were perfect, a mismatch would always mean a thief. In reality, an AVS mismatch is often just a sign of a human living a complex life.

When merchants set rigid "Auto-Decline" rules for AVS codes, they fail to account for the chaotic nature of modern shopping. A mismatch doesn’t necessarily mean malice; more often, it means mistake.

Here are the four most common "False Positives"—legitimate customers who get caught in the net.

1. The "Life in Motion" Shopper

People move. In the US alone, millions of people change addresses every year.

The Scenario: A college student orders a laptop to their new dorm room. They enter the dorm address as the billing address because that is where they live now.

The Mismatch: The bank still has their parents' home address on file.

The Result: AVS returns a partial or no match. A rigid filter declines the order, losing a high-value sale from a verified student email (.edu) simply because the paperwork hasn't caught up with their physical location.

2. The "Fat Finger" Mobile Effect

E-commerce has moved to mobile, but keypads haven't gotten any bigger.

The Scenario: A customer is buying a pair of sneakers while riding the bus. They type "109 Main St" instead of "1090 Main St" due to a small screen and a bumpy ride.

The Mismatch: The street number doesn't match the bank record.

The Result: The AVS system flags it as a mismatch. Data shows that 94% of mobile orders with a partial AVS match are legitimate. Rejecting these is effectively punishing your customers for using their phones.

3. The "Gifting" Glitch

The Scenario: A customer buys a gift for a friend. When asked for the "Billing Address," they absentmindedly enter the "Shipping Address" (the friend's house) again, or they assume the merchant needs to know where the package is going, not where the bill is going.

The Mismatch: The friend's address obviously does not match the buyer's credit card file.

The Result: Code N (Mismatch). The merchant sees a high-value order shipping to a different address than the cardholder's (a standard fraud indicator), but in this context, it is a generous legitimate transaction.

4. The International Gap

Most credit card issuers outside the US, Canada, and the UK do not support AVS.

The Scenario: A wealthy tourist from Australia tries to order from a US boutique.

The Mismatch: The system returns Code G, I, or S (Not Supported/Available).

The Result: Many standard filters interpret "Data Unavailable" as "High Risk" and decline the order. This effectively geofences your business, blocking international revenue streams entirely.

The Bottom Line: Context is King

In all these cases, the "Mismatch" was real, but the "Fraud" was not. A human reviewer (or a modern AI solution) would look at other indicators: Does the email match the name? Is the IP address local? Is the device ID recognized?

Rigid AVS filters ignore these green lights and focus solely on the one red light, leading to a phenomenon known as the Revenue Conundrum: You are saving pennies on fraud prevention while losing dollars on legitimate sales.

The Trojan Horse: Why "AVS Match" Can Be Dangerous

If an AVS Mismatch is a "false alarm," an AVS Match is often a "false sense of security."

Many merchants operate under the dangerous assumption that if the green light flashes—if the address and ZIP code match—the order is safe. This creates a vulnerability that sophisticated fraudsters are eager to exploit. In fact, relying solely on AVS verification is like checking a guest's ID card but ignoring the fact that they are wearing a ski mask.

The "Fullz" Economy

On the dark web, credit card details are rarely sold in isolation. They are sold as packages known as "Fullz".

A "Fullz" dossier includes not just the credit card number and CVV, but also the cardholder's full name, billing address, and phone number. When a professional fraudster buys this data, they have everything they need to pass your AVS filter with a perfect "Code Y" match.

The "Numeric" Loophole

Remember that AVS only checks the numbers (Street Number + ZIP). Fraudsters know this and use it to trick the system while receiving physical goods.

The Trick: The fraudster has a stolen card belonging to a victim at 10 Astor Place, New York, 10003.

The Drop: They want the package delivered to themselves, but they can't change the shipping address too drastically or it triggers other fraud alerts.

The Exploit: They search for a nearby address that shares the same numeric values. They find a drop-point (an abandoned house or a mule) at 10 Irving Place, New York, 10003.

The Result: They enter 10 Irving Place as the billing address. The AVS system sees "10" and "10003." It matches the bank's "10" and "10003." The merchant ships the goods to the thief, believing they verified the victim.

The Digital Goods Blind Spot

The rise of digital downloads (gift cards, software, tickets) has made AVS bypass even easier.

Since there is no physical product to ship, the fraudster doesn't need to manipulate the address at all.

They enter the victim's real billing address perfectly.

The AVS returns a perfect match.

The merchant approves the order instantly.

The "product" (the license key or gift code) is sent to the fraudster's email address.

In these cases, the AVS filter is effectively useless. It verifies the payer, but it ignores the recipient.

Summary: A Broken Shield

Relying on AVS as your primary line of defense leaves you exposed to two distinct failures:

False Positives: You reject legitimate revenue from honest customers with messy data.

False Negatives: You approve professional fraudsters with perfect data.

The Fix: From "Gatekeeping" to "Revenue Recovery"

If relying solely on AVS is a profit-killing strategy, what is the alternative? The answer lies in shifting your mindset from Gatekeeping (trying to keep people out) to Revenue Recovery (trying to let valid people in).

At Guzco.ai, we believe that a data mismatch should trigger an investigation, not an immediate rejection. By replacing binary "Yes/No" filters with a multi-layered AI approach, merchants can recover the 10-15% of revenue currently being lost to false declines.

Here is how a modern, context-aware system turns "Mismatch" into "Approved."

1. The Holistic "Identity Graph"

Instead of looking at a transaction through a keyhole (AVS), Guzco.ai looks at the whole room. We analyze thousands of data points in milliseconds to build a complete profile of the user.

Device Fingerprinting: Has this device been seen before? Is it consistent with the user's history?

Behavioral Biometrics: How fast did they type? Did they copy-paste the address (common in fraud) or type it out (common in legitimate users)?

Proxy Detection: Is the IP address residential, or is it a data center VPN often used by bad actors?

The Result: If a customer makes an AVS typo, but their device ID is trusted and their IP location matches the shipping city, our system recognizes the intent as genuine and approves the order.

2. Intelligent Error Handling

When a "Fat Finger" typo occurs, the old method was to punish the customer with a decline. The new method is Dynamic Friction.

If Guzco.ai detects a typo that looks like a legitimate mistake (e.g., "109 Main" vs "1090 Main"), the system can intervene intelligently. Instead of a hard decline, we can prompt the user to double-check their entry, or we can validate the order in the background using alternative data sources like email domain verification or phone geolocation match.

3. The Network Effect

The power of AI lies in shared knowledge. A standalone AVS filter knows nothing about the world; it only knows the numbers it is fed.

Guzco.ai leverages a global merchant network. If a specific "AVS Mismatch" pattern—like the University Dorm scenario—has been verified as legitimate for a merchant in Chicago, our machine learning models apply that learning instantly to a merchant in London. We know that 123 University Drive is a safe shipping location, regardless of what the AVS code says.

4. Reclaiming the "Gray Zone"

The biggest opportunity for revenue growth isn't in the clear-cut fraud (the dark web criminals) or the clear-cut good customers (the perfect matches). It is in the Gray Zone—the messy middle where AVS mismatches live.

By turning off rigid AVS auto-declines and letting Guzco.ai evaluate the context, you effectively widen the funnel at the bottom. You catch the fraudster using the "Trojan Horse" method because our behavioral analysis spots their spoofed IP, while simultaneously letting the honest "Life in Motion" student pass through.